Automated forex trading, also known as algorithmic trading, has quickly gained traction in the currency trading industry. It allows traders to make transactions based on predetermined criteria without the need for manual intervention. The rise of technology and the internet has played a vital role in this evolution, making it more accessible to both seasoned and novice traders alike. Many traders are now turning to automated solutions to enhance their trading strategies. For those seeking local options, automated forex trading Turkey Brokers offer a range of services suited for automated trading.

What is Automated Forex Trading?

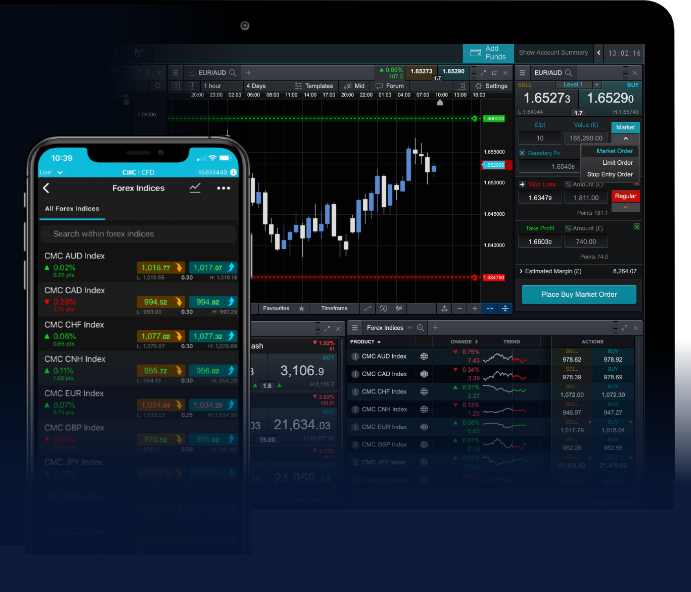

Automated forex trading involves using computer software to execute trades based on a set of defined criteria. These criteria usually include factors like price movements, currency pair performance, and historical data analyses. Traders create algorithms or use pre-built trading robots that analyze market conditions and place trades automatically, increasing the potential for profits while removing the emotional component of trading.

How Automated Trading Works

Automated trading systems, also known as Expert Advisors (EAs) in through MetaTrader platforms, are programmed to perform trades on behalf of the trader. Here’s a breakdown of how it works:

- Strategy Development: Traders must first develop a trading strategy. This may involve technical analysis, fundamental analysis, or a combination of both.

- Algorithm Programming: Once the strategy is identified, traders or programmers must translate it into a coding language that the trading platform can understand.

- Backtesting: Before deploying the algorithm in a live market, traders typically backtest it using historical data to evaluate its performance.

- Execution: Once backtested, the automated trading system can be deployed to enter and exit trades according to the established criteria.

Benefits of Automated Forex Trading

Automated forex trading offers numerous advantages for traders, including:

- Emotionless Trading: Algorithms operate strictly on data and predefined rules, effectively removing emotional decision-making that can lead to trading mistakes.

- Precision and Speed: Automated systems can react to market changes in mere milliseconds, allowing traders to seize opportunities that may otherwise be missed.

- Efficient Monitoring: Automated systems can continuously monitor the market and execute trades around the clock, without the need for physical presence or manual oversight.

- Tested Strategies: Traders can test their strategies using historical data to validate their effectiveness before going live, increasing the chances of success.

Risks Involved in Automated Trading

Despite the many benefits, automated forex trading also carries inherent risks that traders must be aware of:

- Market Volatility: Automated systems can be sensitive to sudden market shifts, which may lead to unexpected losses if not adequately programmed to handle volatility.

- System Failures: Technical issues, such as software glitches or internet outages, can hinder the performance of automated trading systems, resulting in missed trades or financial loss.

- Over-Optimization: While backtesting is essential, over-optimizing an algorithm based on historical data can result in systems that perform poorly in live trading due to changing market conditions.

- Dependency on Technology: Relying entirely on automated systems can leave traders vulnerable in case of system failures or malfunctions.

Choosing the Right Automated Trading System

For those interested in automated forex trading, selecting the right system is crucial. Here are several factors to consider:

- Reputation: Research the company’s background, customer reviews, and performance history of the automated trading system.

- Customizability: An effective system should allow for personalized adjustments based on the trader’s strategy and risk tolerance.

- Support and Resources: Look for systems that offer support and educational resources to help traders understand and maximize their platform’s capabilities.

- Cost: Understand the pricing structure. Some systems charge upfront fees, while others may take a percentage of profits.

Future of Automated Forex Trading

The future of automated forex trading looks promising, with continuous advancements in technology, machine learning, and artificial intelligence (AI). As algorithms become more sophisticated, traders can expect even greater efficiency, accuracy, and adaptability in their trading strategies. Additionally, regulatory advancements may provide a more secure trading environment, helping to mitigate some of the risks associated with automated trading.

Conclusion

Automated forex trading has transformed the way individuals trade currencies, providing them with tools to enhance efficiency and effectiveness. However, while the benefits are compelling, traders must also take great care to understand the associated risks. As technology evolves, so too will the landscape of forex trading, making it essential for traders to stay informed and adaptable.

In conclusion, the emergence of automated trading represents a shift in how traders approach the forex market. By leveraging technology, traders can pursue opportunities with more precision and less emotional interference. Nonetheless, they must also integrate risk management practices and continually monitor their trading systems to succeed in this dynamic environment.