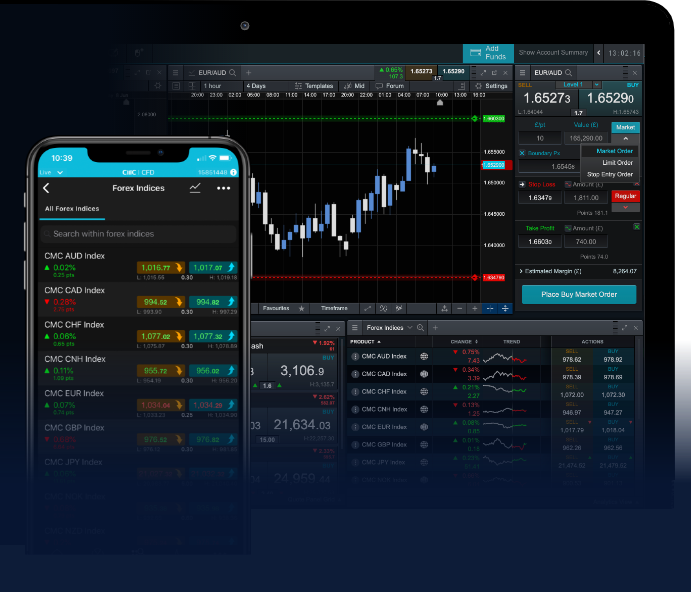

Forex trading can be an exciting and lucrative venture, but for beginners, it can also be overwhelming. The foreign exchange market is the largest and most liquid financial market in the world, and understanding the various strategies available can make a significant difference in your trading success. By leveraging appropriate forex trading strategies for beginners Forex Trading Platforms and applying the right strategies, you can enhance your ability to trade wisely. In this article, we’ll explore some fundamental forex trading strategies that are ideal for those just starting on their trading journey.

Understanding the Forex Market

Before diving into trading strategies, it is crucial to understand what forex trading is. The forex market operates 24 hours a day, five days a week, and involves currency pairs where one currency is exchanged for another. Traders make profits through fluctuations in currency prices. A solid understanding of key terms and concepts such as pips, leverage, and spread will prepare you for effective trading.

Key Forex Trading Strategies for Beginners

1. Trend Following

One of the simplest strategies for beginners is trend following. This strategy focuses on identifying and following the prevailing direction of the market. If the market trends upward, you would look to buy, while in a downtrend, you would seek to sell. Traders utilize technical analysis tools such as moving averages to help identify trends over different time frames.

2. Range Trading

Range trading involves identifying key support and resistance levels in the market. When the price bounces between these levels, traders can capitalize on these fluctuations. A popular approach is to buy when the price approaches the lower boundary of the range and sell as it rises toward the upper boundary. Patience and discipline are vital in this strategy, as traders must wait for these key levels to present themselves.

3. Breakout Trading

Breakout trading occurs when fluctuations in a currency pair exceed a defined range. This strategy involves anticipating a price explosion, either upward or downward, after a period of consolidation. Traders typically place trades in the direction of the breakout, anticipating continued momentum. Confirmation from additional indicators can help minimize the risks associated with false breakouts.

4. Scalping

Scalping is a high-frequency trading strategy that involves making numerous trades within a short timeframe, often minutes. Scalpers aim for small profits from minor price changes, capitalizing on tight spreads. This strategy demands a significant commitment of time and disciplined focus, as traders must monitor prices closely and react quickly to market movements.

5. Carry Trade

A carry trade exploits the interest rate differential between two currencies. Traders borrow funds in a currency with a low-interest rate and invest them in a currency with a higher interest rate. As they earn the interest rate differential, they can also profit from favorable currency fluctuations. While potentially rewarding, this strategy comes with risks, mainly related to currency volatility and interest rates.

Essential Tips for Beginner Forex Traders

1. Develop a Trading Plan

Your trading plan should outline your trading goals, risk tolerance, preferred strategies, and money management guidelines. A well-structured plan helps keep your emotions in check and limits impulsive decisions in the heat of trading.

2. Use a Demo Account

Many brokers offer demo accounts, allowing beginners to practice trading with virtual currency. This gives you a risk-free way to familiarize yourself with trading platforms and strategies without the stress of real money. Take advantage of this opportunity to refine your skills and test strategies before engaging in live trading.

3. Manage Your Risks

Risk management is a crucial aspect of forex trading. Always determine how much capital you are willing to risk on each trade. A common rule is to risk no more than 1-2% of your total trading capital on a single trade. Utilizing stop-loss orders can help limit potential losses and protect your trading capital.

4. Stay Informed About Market News

The forex market is influenced by a myriad of factors, including economic indicators, geopolitical events, and central bank decisions. Staying informed about relevant news and trends will enhance your ability to make informed trading decisions. Utilize resources such as economic calendars and financial news websites to keep track of market-moving events.

5. Keep a Trading Journal

Maintaining a trading journal is an excellent way to track your performance, analyze your strategies, and identify areas for improvement. Document your trades, including entry and exit points, reasons for the trade, and outcomes. Over time, this practice will help you develop a better understanding of your trading habits and refine your overall approach.

Conclusion

Forex trading can be a rewarding pursuit, but it requires dedication, patience, and a solid understanding of various strategies. By starting with the strategic foundations outlined above, beginners can build a strong framework for trading as they gain experience and confidence in the forex market. Remember, there is no one-size-fits-all approach in trading; therefore, be open to adapting your strategies as you learn and grow. Happy trading!